Item Details

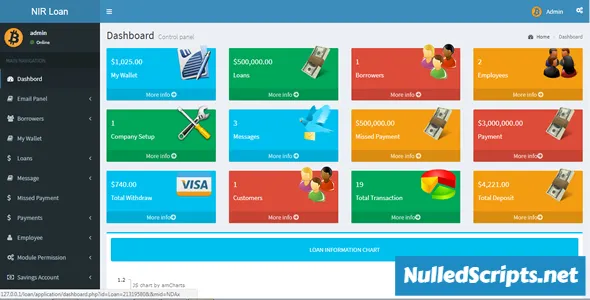

LMS - Make bank loan management easier LMS is a modern and responsive loan management system. It is developed using PHP and HTML 5. It is designed and developed for companies, banks, etc. that require simplified credit management, savings account and SMS notification system. The system also automates the processes of savings, loans and payments. This software is a web-based application used by most cooperatives, mini banks, microfinance banks, etc. to process credit and savings transactions.

Features

User Management:

- Admin, staff, borrower, and saver profiles.

- Access control and permissions for different user roles.

Loan Management:

- Create and manage different types of loans (e.g., personal, business, mortgage).

- Loan application and approval process.

- Interest rate calculation.

- Amortization schedules.

- Track disbursements and repayments.

- Late payment handling.

- Early loan settlement options.

- Collateral management.

Savings Account Management:

- Create and manage savings accounts for customers.

- Set minimum balance requirements.

- Interest rate calculation.

- Allow deposits and withdrawals.

- Track account balances and transactions.

- Provide periodic account statements.

SMS Notification System:

- Automated SMS notifications for various events:

- Loan application status updates.

- Loan disbursement and repayment reminders.

- Savings account balance alerts.

- Overdue loan payment reminders.

- Transaction confirmations.

- Integration with SMS gateway providers.

- Automated SMS notifications for various events:

Payment Processing:

- Integration with payment gateways for loan disbursements and repayments.

- Flexible payment methods (credit/debit card, bank transfer, cash).

- Real-time payment tracking.

Credit Scoring and Risk Assessment:

- Assess borrower creditworthiness.

- Assign credit scores.

- Use risk models to make lending decisions.

Reporting and Analytics:

- Generate various reports (e.g., loan portfolio analysis, financial statements).

- Customizable dashboards for real-time insights.

- Trend analysis and forecasting tools.

Customer Relationship Management (CRM):

- Maintain customer profiles.

- Communication history (emails, calls, meetings).

- Lead and opportunity management for potential borrowers.

Document Management:

- Store and manage loan agreements, customer documents, and financial records.

Compliance and Regulations:

- Ensure adherence to financial regulations.

- Generate compliance reports.

Security:

- Data encryption and access controls.

- Regular data backups and disaster recovery plans.

Notifications and Alerts:

- Email notifications for important events in addition to SMS.

Mobile Access:

- A responsive web application or a dedicated mobile app for borrowers and savers.

Integration:

- Integration with core banking systems or third-party services.

Audit Trail:

- Record and log all system activities for auditing and compliance purposes.

Customer Support:

- Helpdesk and support ticket system for borrower and saver inquiries.

Scalability:

- Design the system to handle a growing customer base and increased transaction volume.