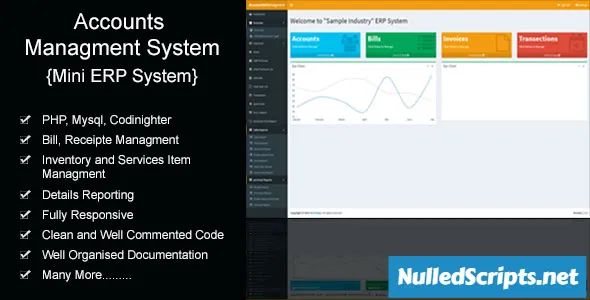

Item Details

A system for managing invoicing, transactions with stock items, service items and transactions for clients with reports on stock items, each client, service item and total debit, credit reports. The system can be used in any industry such as cotton ginning, commodity traders, small scale processing industries.

Features

User Authentication and Access Control: Secure login and role-based access to ensure that only authorized personnel can access sensitive financial data.

Dashboard: An overview of the financial health of the organization, including key financial metrics and charts.

Chart of Accounts: A hierarchical list of all accounts used in financial transactions, typically categorized by type (e.g., assets, liabilities, equity, income, and expenses).

General Ledger: A record of all financial transactions, including debits and credits, organized by account.

Income and Expense Tracking: Record and categorize all income and expenses.

Bank Reconciliation: Match and reconcile bank statements with recorded transactions to identify discrepancies.

Invoicing and Billing: Create and send invoices to customers, track payments, and generate reports on accounts receivable.

Accounts Payable: Manage bills, expenses, and payments to vendors and suppliers.

Financial Reporting: Generate financial statements such as balance sheets, income statements, and cash flow statements.

Budgeting and Forecasting: Set and monitor financial goals, and compare them to actual performance.

Tax Management: Calculate and track taxes, and generate reports for tax compliance.

Multi-Currency Support: Handle transactions in different currencies, with automatic exchange rate conversions.

Audit Trail: Maintain a detailed log of all changes made to financial records for accountability and compliance purposes.

Document Attachment: Attach and store relevant documents (e.g., receipts, invoices) with financial transactions.

Fixed Asset Management: Track and manage company assets, including depreciation calculations.

Multi-User Collaboration: Allow multiple users to collaborate on financial data simultaneously.

Integration with Banking and Payment Services: Connect with banks and payment processors for seamless transaction synchronization.

Data Import/Export: Easily import and export financial data to and from other systems or spreadsheets.

Data Security: Implement data encryption and regular backups to safeguard financial information.

Compliance and Audit Support: Ensure compliance with financial regulations and provide tools for audit preparation.

Customization: Adapt the system to specific business needs through customizable fields and workflows.

Mobile Accessibility: Access and manage financial data on mobile devices for on-the-go accounting.

Notification and Alerts: Receive notifications for important financial events or deadlines.

Expense Tracking: Record and categorize employee expenses, and manage reimbursements.

Credit Control: Monitor and manage credit limits and customer credit terms.

Vendor and Customer Management: Maintain records of vendors, suppliers, and customers.

Analytics and Insights: Provide data analysis tools to help businesses make informed financial decisions.